Thornapple Credit Union is a member-owned, not-for-profit cooperative financial institution.

T (269) 948 - 8369

Email: contact@thornapplecu.com

Thornapple Credit Union

202 E. Woodlawn, Hastings, MI. 49058

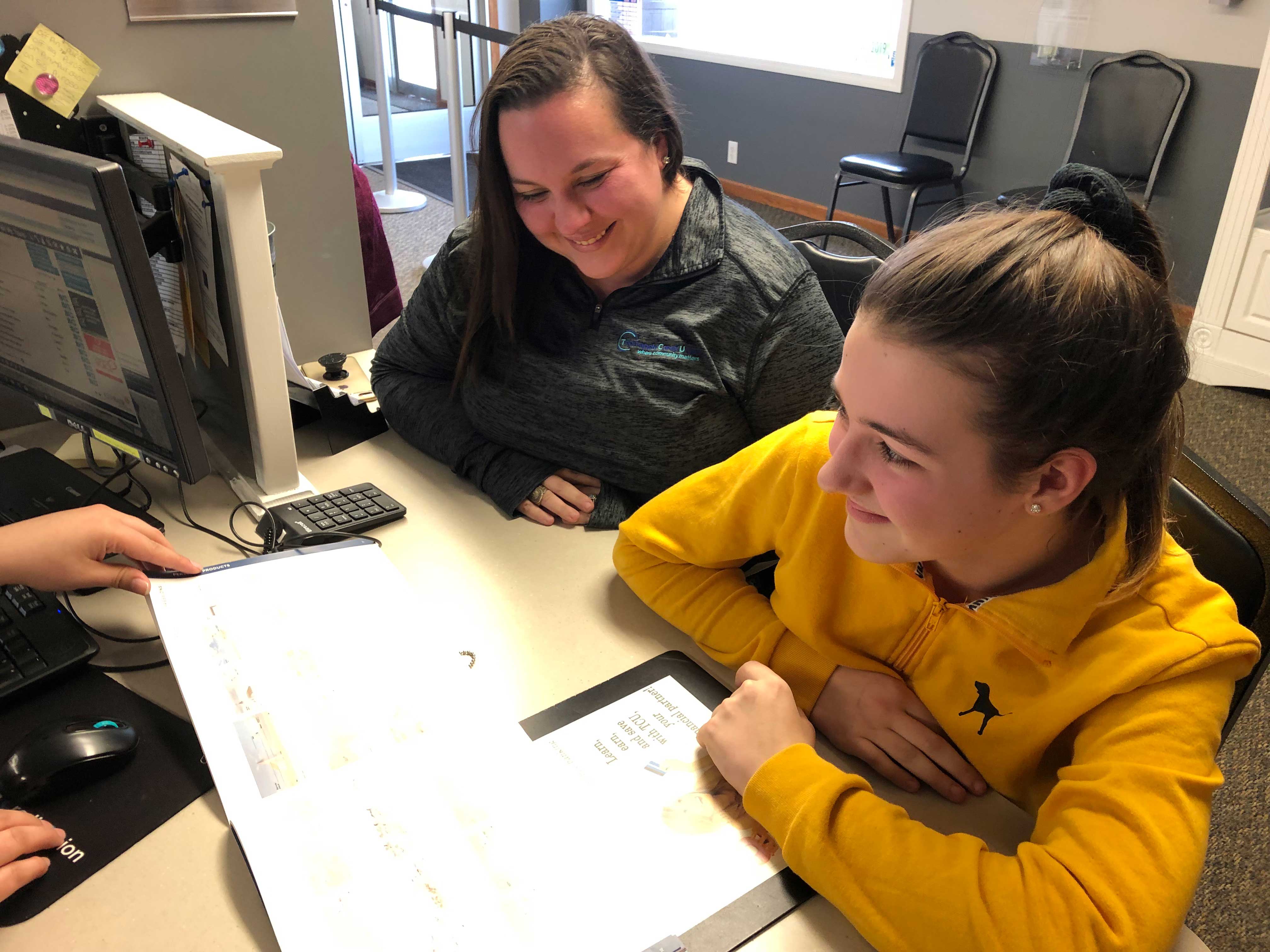

YOUTH ACCOUNTS

TCU offers children ages 17 years or younger the opportunity to learn about the value of a sound savings plan.

CHECKING ACCOUNTS

If you’re wondering what it’s like to bank with Thornapple Credit Union, just take a look at our checking accounts.

USA Patriot Act Disclosure: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain. verify, and record information that identifies each person who opens an account.

LARRY WARREN

CASSANDRA THAYER